What is Insurance: Definition, How It Works, and Main Types

Insurance is a complex financial tool that plays a pivotal role in managing risk and safeguarding individuals and organizations from unexpected financial burdens. This comprehensive guide delves into the world of insurance, from its fundamental definition to an in-depth exploration of how it operates and the diverse array of insurance policies available.

Understanding Insurance: A Fundamental Definition

Insurance is a contractual agreement between two parties: the insured (individual or entity seeking protection) and the insurer (the company or organization offering coverage). In this arrangement, the insured pays regular premiums to the insurer. In return, the insurer commits to providing financial compensation to the insured should specific, predetermined events or risks materialize. The primary objective of insurance is to transfer the financial risk associated with these events from the insured to the insurer, thereby ensuring a level of financial security and peace of mind.

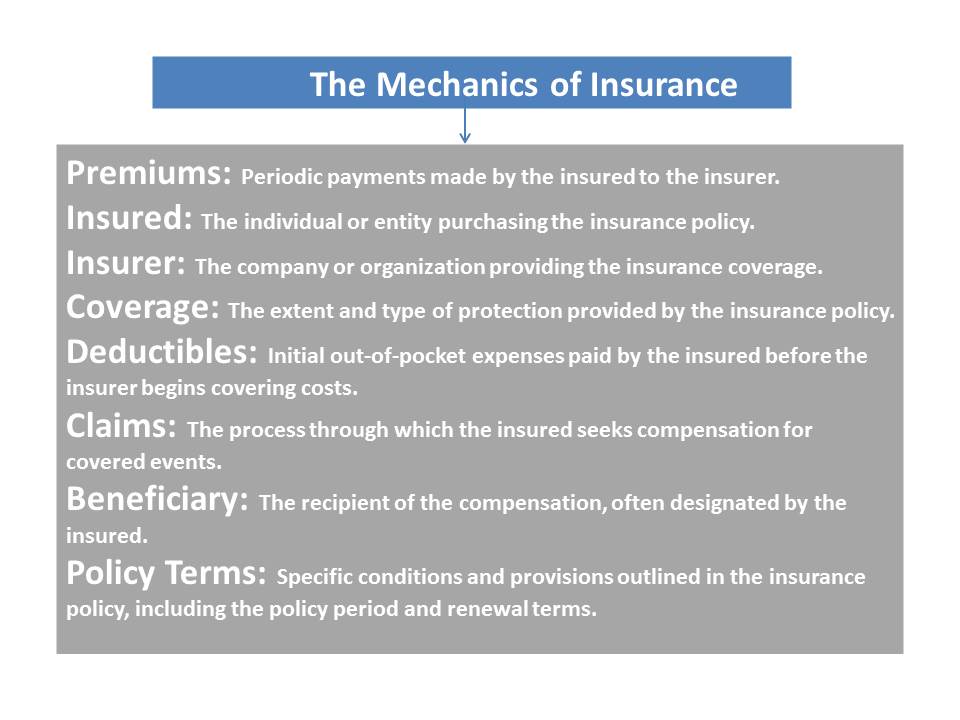

Key Terms:

- Premiums: Periodic payments made by the insured to the insurer.

- Insured: The individual or entity purchasing the insurance policy.

- Insurer: The company or organization providing the insurance coverage.

- Coverage: The extent and type of protection provided by the insurance policy.

- Deductibles: Initial out-of-pocket expenses paid by the insured before the insurer begins covering costs.

- Claims: The process through which the insured seeks compensation for covered events.

- Beneficiary: The recipient of the compensation, often designated by the insured.

- Policy Terms: Specific conditions and provisions outlined in the insurance policy, including the policy period and renewal terms.

The Mechanics of Insurance

To grasp how insurance operates, it’s essential to understand the step-by-step process involved.

1. Premium Payments

The insurance process commences with the insured making regular premium payments to the insurer. Premiums can be paid on various schedules, including monthly, quarterly, or annually. The amount of these payments is determined by several factors, including the type of coverage, the level of coverage, and the insured’s risk profile.

2. Policyholder and Insured

The policyholder is the individual or entity that purchases the insurance policy and is responsible for paying the premiums. Often, the policyholder is also the insured—the person or entity covered by the insurance policy.

3. Coverage

Insurance policies specify the type and extent of coverage provided. This section outlines the events or risks that the policy covers and the amount of compensation available in each case. Policies can vary significantly in their scope and specificity, depending on the insurer and the type of coverage.

4. Deductibles

Many insurance policies include deductibles, which represent the initial out-of-pocket expenses the insured must pay before the insurer begins providing coverage. Deductibles are designed to discourage minor or frivolous claims and to ensure that insurance is primarily used for significant losses.

5. Claims

When an insured event occurs, the policyholder initiates the claims process by submitting a formal claim to the insurance company. The insurer then assesses the claim to determine its validity and whether it falls within the policy’s coverage parameters. If the claim is approved, the insurer provides compensation as specified in the policy.

6. Beneficiary

The compensation provided by the insurance company is usually paid either directly to the policyholder or to a designated beneficiary. In life insurance, for instance, the beneficiary is typically a family member or loved one who receives the payout upon the insured’s death.

7. Policy Terms

Insurance policies are governed by specific terms and conditions, often outlined in lengthy and detailed policy documents. These terms define the duration of the policy (policy period) and any provisions for renewal. Policy terms may also include exclusions and limitations—events or circumstances that are not covered by the policy.

Exploring the Main Types of Insurance Policies

Insurance is not a one-size-fits-all solution; it comes in various forms tailored to address different aspects of life and business. Here are the primary types of insurance policies:

1. Life Insurance

Life insurance provides financial protection to the beneficiaries of the insured individual in the event of their death. It serves as a crucial tool for ensuring that loved ones are financially secure following the insured’s passing. There are several subtypes of life insurance:

- Term Life Insurance: This policy provides coverage for a specified term, typically 10, 20, or 30 years. It offers a straightforward death benefit and is often more affordable than other forms of life insurance.

- Whole Life Insurance: Whole life insurance is a permanent policy that provides coverage for the entire lifetime of the insured. It typically has a cash value component that grows over time.

- Universal Life Insurance: Universal life insurance combines a death benefit with a savings or investment component. Policyholders can adjust their premiums and death benefits, offering flexibility in managing the policy.

2. Health Insurance

Health insurance covers medical expenses, ensuring individuals and families can access necessary healthcare services without incurring crippling costs. This type of insurance encompasses a wide range of medical needs, including:

- Doctor Visits: Coverage for routine check-ups and appointments.

- Hospitalization: Protection against the high costs of hospital stays and surgeries.

- Prescription Drugs: Assistance with the expense of necessary medications.

- Preventive Care: Coverage for vaccinations and preventive screenings.

Health insurance can be obtained through employers, government programs (e.g., Medicare and Medicaid), or purchased independently on the open market.

3. Auto Insurance

Auto insurance is designed to safeguard vehicle owners against financial losses associated with accidents, theft, or damage to their vehicles. Key components of auto insurance include:

- Liability Coverage: This aspect of auto insurance pays for damages and injuries caused to others in accidents where the insured is at fault.

- Collision Coverage: Covers damage to the insured’s vehicle resulting from collisions with other objects, such as another car or a stationary object.

- Comprehensive Coverage: Protects against non-collision-related damages, including theft, vandalism, and natural disasters.

Auto insurance is typically required by law in most places, with minimum coverage requirements varying from one jurisdiction to another.

4. Homeowners or Renters Insurance

Homeowners insurance and renters insurance serve the critical purpose of protecting individuals from losses related to their homes or personal property.

- Homeowners Insurance: This type of policy covers damages to a homeowner’s dwelling, personal property, and liability for accidents that occur on the property. It also often includes coverage for additional living expenses if the home becomes uninhabitable.

- Renters Insurance: Renters insurance is similar to homeowners insurance but is tailored for those who rent their living spaces. It covers personal property, liability, and additional living expenses.

Both types of insurance protect against events such as fire, theft, and certain natural disasters, offering financial security and peace of mind to individuals and families.

5. Business Insurance

Business insurance is a broad category encompassing various policies tailored to protect businesses from financial losses. This is especially critical because businesses face a range of unique risks that can be devastating without proper coverage. Some key forms of business insurance include:

- Commercial Property Insurance: Covers damage or loss to a business’s physical property, such as buildings, inventory, and equipment.

- Liability Insurance: Protects businesses from legal claims and expenses if they are found responsible for causing harm to others or damaging their property.

- Workers’ Compensation Insurance: Provides compensation to employees who suffer work-related injuries or illnesses, helping businesses fulfill their legal obligations and care for their workforce.

- Business Interruption Insurance: Offers coverage for lost income and certain operating expenses when a business is unable to operate due to a covered event, such as a fire or natural disaster.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this coverage protects professionals (e.g., doctors, lawyers, consultants) against claims of negligence or inadequate work.

6. Travel Insurance

Travel insurance is designed to provide coverage during trips, offering protection against various unexpected events that can disrupt travel plans or result in financial losses. Common types of travel insurance include:

- Trip Cancellation/Interruption Insurance: Reimburses the cost of canceled or interrupted trips due to unforeseen events, such as illness, accidents, or natural disasters.

- Travel Medical Insurance: Provides coverage for medical expenses incurred while traveling abroad, including emergency medical treatment and evacuation.

- Baggage and Personal Belongings Insurance: Protects against the loss, theft, or damage of luggage and personal items during travel.

- Rental Car Insurance: Offers coverage when renting a car, supplementing the insurance provided by rental car companies.

Travel insurance can be invaluable when navigating the uncertainties of international or domestic travel.

7. Liability Insurance

Liability insurance is a broad category of coverage that protects individuals and businesses from legal claims and expenses when they are found responsible for causing harm to others or damaging their property. Various types of liability insurance are tailored to specific needs:

- General Liability Insurance: Provides protection for businesses against claims of bodily injury or property damage to third parties.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, this coverage is crucial for professionals (e.g., doctors, lawyers, consultants) and protects against claims of negligence or inadequate work.

- Product Liability Insurance: Protects businesses that manufacture or sell products against claims of injuries or property damage resulting from their products’ defects or hazards.

- Umbrella Liability Insurance: Offers additional coverage beyond the limits of other liability policies, providing an extra layer of protection in case of substantial claims.

Liability insurance is essential for mitigating the financial risks associated with legal disputes.

8. Disability Insurance

Disability insurance is a specialized policy that provides income replacement if an individual becomes unable to work due to illness or injury. It serves as a crucial safeguard for individuals who rely on their income to support themselves and their families.

- Short-Term Disability Insurance: Provides coverage for a limited period, typically a few months, after the insured becomes disabled.

- Long-Term Disability Insurance: Offers coverage for an extended period, potentially until retirement age, in the event of a long-term disability.

Disability insurance helps individuals maintain financial stability when they are unable to earn an income due to a disability.

9. Pet Insurance

Pet insurance is a relatively recent addition to the insurance landscape, offering coverage for veterinary expenses related to pets. This type of insurance ensures that pet owners can provide necessary medical care without facing significant financial burdens.

Pet insurance typically covers various veterinary services, including:

- Illness: Treatment for common and severe illnesses.

- Accidents: Medical care resulting from accidents or injuries.

- Preventive Care: Routine check-ups, vaccinations, and preventive treatments.

- Hereditary and Chronic Conditions: Coverage for genetic or long-term health issues.

Pet insurance helps pet owners ensure the well-being of their furry family members while managing veterinary expenses.

In Conclusion

Insurance is a multifaceted financial tool that provides security and peace of mind in an unpredictable world. It operates through a structured process involving premium payments, coverage, deductibles, claims, and policy terms. The diverse array of insurance policies available addresses the unique needs of individuals, families, and businesses across various aspects of life and commerce.

Understanding the intricacies of insurance is crucial for making informed decisions about coverage. By choosing the right insurance policies tailored to their specific needs and circumstances, individuals and organizations can proactively manage risks and safeguard their financial well-being. Insurance ultimately empowers us to face the future with greater confidence, knowing that we have a safety net in place should the unexpected occur.

Top of Form